1. Procedures

Technology is only as good as the procedures embedded within it because technology is a major CAPEX investment. A return is only achieved when watertight procedures are embedded within your EPOS and business management solution. Procedures enable you to constantly see the cash and stock flow through your business. Procedures also help you benchmark and measure your operational performance. All transactions, purchases and stock movements are transparent, trackable and traceable. With them, you know everything that happens in your business. You will always have a full audit trail of the cash you invest and the stock you use.

2. Cash Control

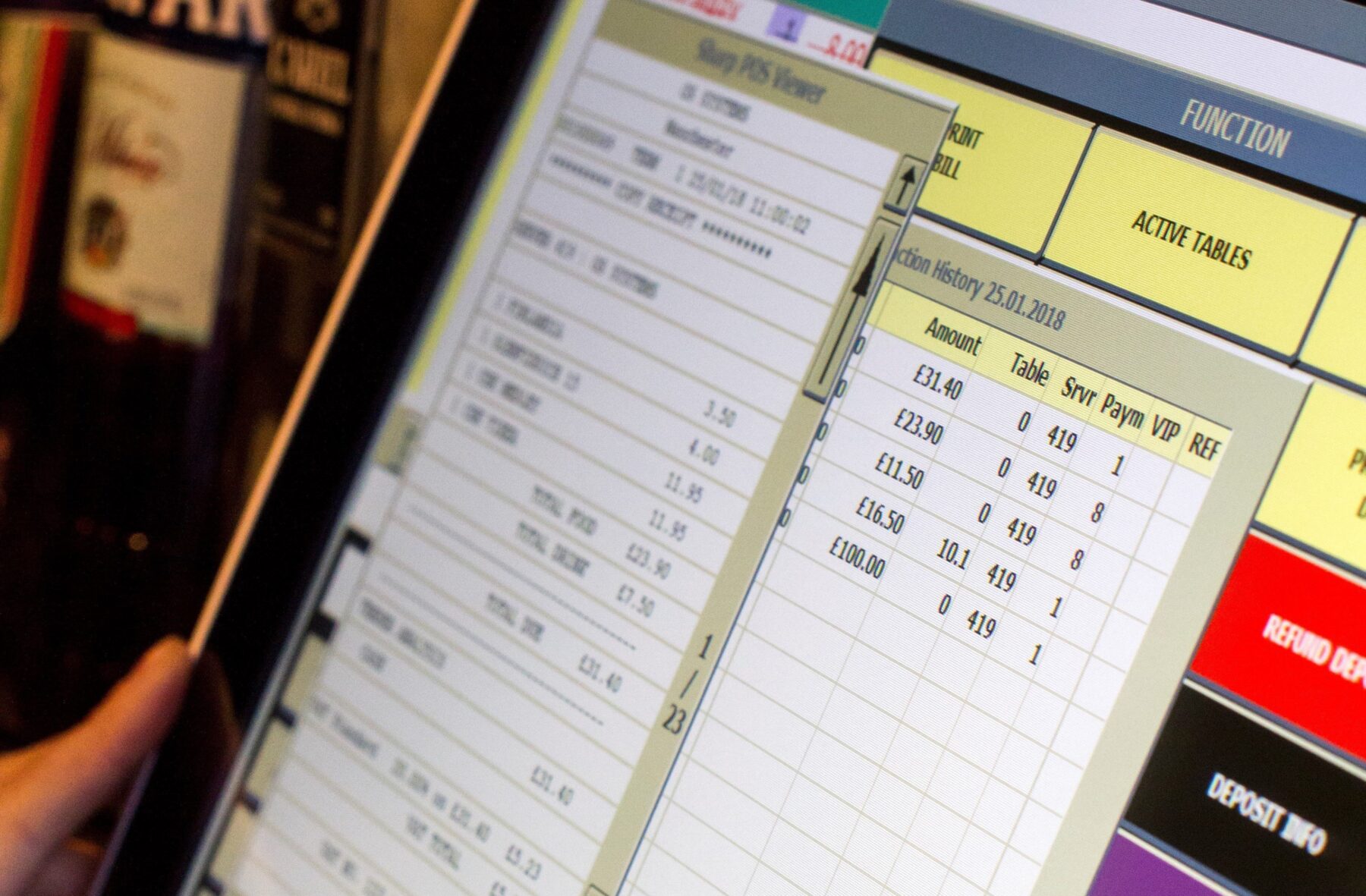

100% accountability ensures you keep cash under strict control. Automated cash reconciliation, using electronic business sheets, balances your systems data flow with the cash, cheques, credit and debit cards and promotional vouchers declared and banked by your managers. Comparing your bank statements with your electronic results enables you to spot and explain discrepancies between the two. Watertight cash reconciliation ensures you and your managers must account for every transaction taking place within your operation, no matter how many sites you have. Focusing on what’s been declared with what should have been banked prevents figure “fudging”.

3. Stock Control

Stock control safeguards resources and benchmarks your business. Regular electronic stock control audits allow you to benchmark and monitor your business performance. Stock audits provide the data platform for your business management solution to produce accurate gross profit margins across all aspects of your operation. Running regular daily line checks and weekly full stock audits ensures you see a true reflection of your business, at all times. Contrast this technological approach to relying on external auditors carrying out a manual monthly or quarterly stock take when it is too late to act.

4. Supplier Purchasing

Electronic supplier purchasing controls spending and highlights discrepancies allowing you to use your EPOS solution to automatically place orders at pre-defined product levels. Orders can only be placed with registered or approved suppliers who sell at pre-agreed prices. Once an order has been sent, its progress can be tracked through the EPOS solution from placement to fulfilment. This process avoids overstocking and overcharging as stock and price discrepancies are highlighted.

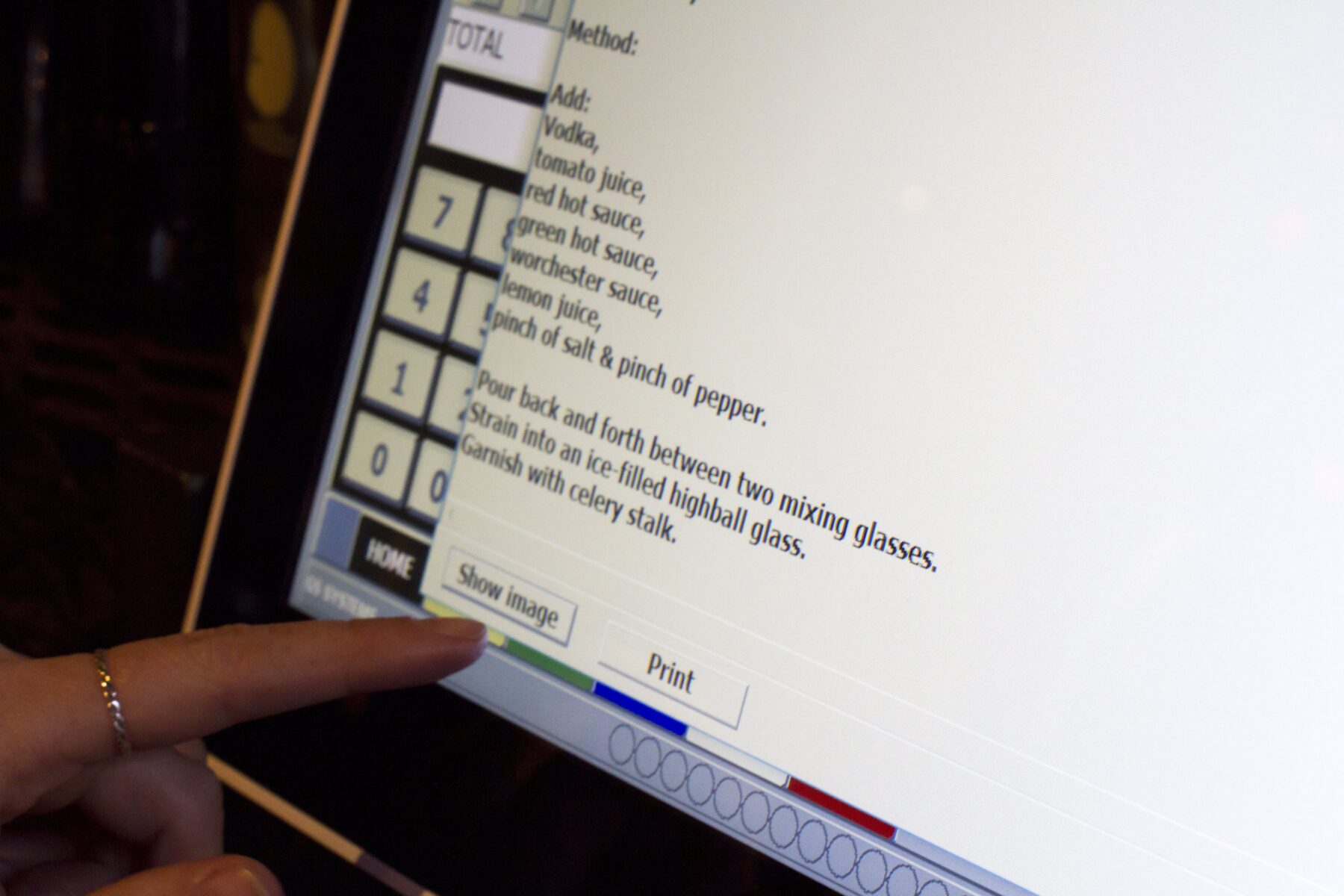

5. Recipe Management

Integrated recipe management compares stock and purchasing data, so you know your wet and dry recipe costs are always up to date and your margins are accurate. You’ll also be able to immediately pinpoint discrepancies caused by excessive portioning or unnecessary wastage. Traditionally, many businesses used Excel spreadsheets, a long winded and often inaccurate manual process, or simply compared the two in isolation from each other.

6. Labour & Staff Management

Despite payroll costs increasing, technology can help manage and control staff wages, your biggest single variable expense that can rise rapidly. According to the ALMR’s bench-marking report, the average increase of wages costs as a percentage of sales has risen from 25.1% to 25.4%. Fortunately, you can use technology to put in place simple measures to benchmark and monitor labour costs. Your EPOS business management solution can be configured to tell you, on a daily basis, what your staff costs are as a percentage of sales for your entire operation or by each cost centre. Future staffing rotas can also be planned using historical and forecast data to ensure you keep a tight rein on your biggest variable cost.

7. Duplication

Technology tools allows data to flow from the EPOS to head office. There are no short cuts to setting up an EPOS and business management solution but investing the time upfront will provide you with huge future benefits. For instance, once your system is operational data at the point of sale or purchase only needs to be entered and recorded once. The data is now able to flow freely from your sites to your head office and your accounting systems. Information can be accessed and actioned by the board or finance, HR, marketing and operational departments

8. Automated Reports

Automated reports generated to your requirements when you want them. Technology gives you immediate access to real time bespoke reports whenever and wherever you need them. The data flow captured by your EPOS business management solution is automatically interpreted and published as key performance indicators or more detailed reports. Viewed on a weekly, daily or even hourly basis, KPI’s show your current performance, identifying gross profit margins (the money you’re making) and staffing costs (your most expensive variable expense).

9. Customer Rewards

Engage and target real people at the point of sale and beyond. Technology creates numerous opportunities to personally engage and reward your guests. Add value to your relationship with them and thank them for their loyalty. Integrating customer databases into your solution enables you to identify guests at the point of sale and create opening for extra “buying” opportunities. Engagement is ongoing and personal. Digital communications mean you can devise, distribute and track customer relationship activities through your solution.

10. Integration & Training

Integration allows seamless data flow between different applications. Remember when operators used different systems within the same premises? One for EPOS, one for reservation and another for loyalty, all operating independently from one another? Those days and associated costs are gone. Data flows seamlessly between customer relationship management programs, accounts packages, conference/ event management systems, hotel front desk, restaurant table reservation solutions – or any other specialist software module, ranging from snooker table and bowling lane management systems to recreational centre solutions and e-commerce.

Experience shows us that when people are trained well, they are far more confident and knowledgeable with the tasks and challenges they face. Did you know that according to statistics produced by Gunter and Amazon.com 57% of people who buy software never use it? And 83% of people who start to use software, never use it again? That’s why it is really important all your front of house staff and managers receive EPOS and technology training (with regular updates and refreshers). Experience shows us that when people are trained well, they are far more confident and knowledgeable with the tasks and challenges they face. Both front of house and in the back office. Knowledge and understanding empowers them to perform to higher levels than untrained peers – and ensure widespread cost efficiencies throughout your operation